Starting Small With Your Hybrid Plan Savings? You Can Still Finish Big

If you’re in the Hybrid Retirement Plan, making the maximum voluntary contribution to the defined contribution component as early as possible is an effective way to grow your retirement savings. But what if it doesn’t fit your current budget?

Use SmartStep to gradually increase your contributions. This helps you work toward the important goal of receiving the full 2.5% employer match. You can adjust the increase percentage, frequency or turn off the feature anytime.

If you’re contributing less than 4% of your income, the Hybrid Retirement Plan has an auto-escalation feature. Your saving rate will increase automatically by 0.5% every three years until you reach that maximum contribution level. The next automatic increase takes effect January 1, 2026. Watch for additional information from Voya Financial this fall. If you are eligible for auto-escalation but don’t want your contribution to increase, you can opt out between December 1 and December 31.

But why not save more for your future as soon as possible? Log in to your DCP Account to increase your contribution now through SmartStep. A small step today is a big step toward your future.

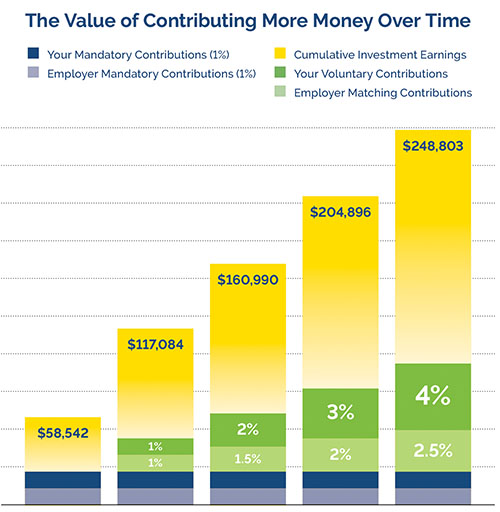

See how contributing more affects future earnings:

Pay Yourself First

If you received a salary bump this year, consider putting those extra earnings toward your future and set yourself up for a more comfortable tomorrow.

Update your contributions before 4 p.m. on the last business day of the month. Changes will take effect in the next month’s pay cycle. Wondering how increasing the amount of your voluntary contributions could affect your paycheck? Use the Paycheck Calculator to find out.

More Ways to Catch Up

If you’ve reached the maximum voluntary contribution amount, you may be looking for other ways to save automatically. If offered by your employer, consider saving via payroll deduction with the Commonwealth of Virginia 457 Deferred Compensation Plan. State employees who contribute $40 per pay period receive a $20 per pay period employer match.

VRS and Voya Financial, the DCP record-keeper, offer more educational resources to help you manage your retirement plan. Explore a variety of calculators, financial planning services, investment advice and more on the DCP Education page.