Your Turn to Ask

If I leave employment and take a refund, how will taxes affect the payout?

If you leave your job, you can take a refund of your member contributions and interest. You will receive a cash payment; however, taking a refund cancels your VRS membership and eligibility for any future benefits.

Should you return to VRS-covered employment before the refund is issued, the refund cannot be paid. Also keep in mind that if you return to VRS-covered employment, you will be hired under the retirement plan in place for that position, which may not be the same plan you left.

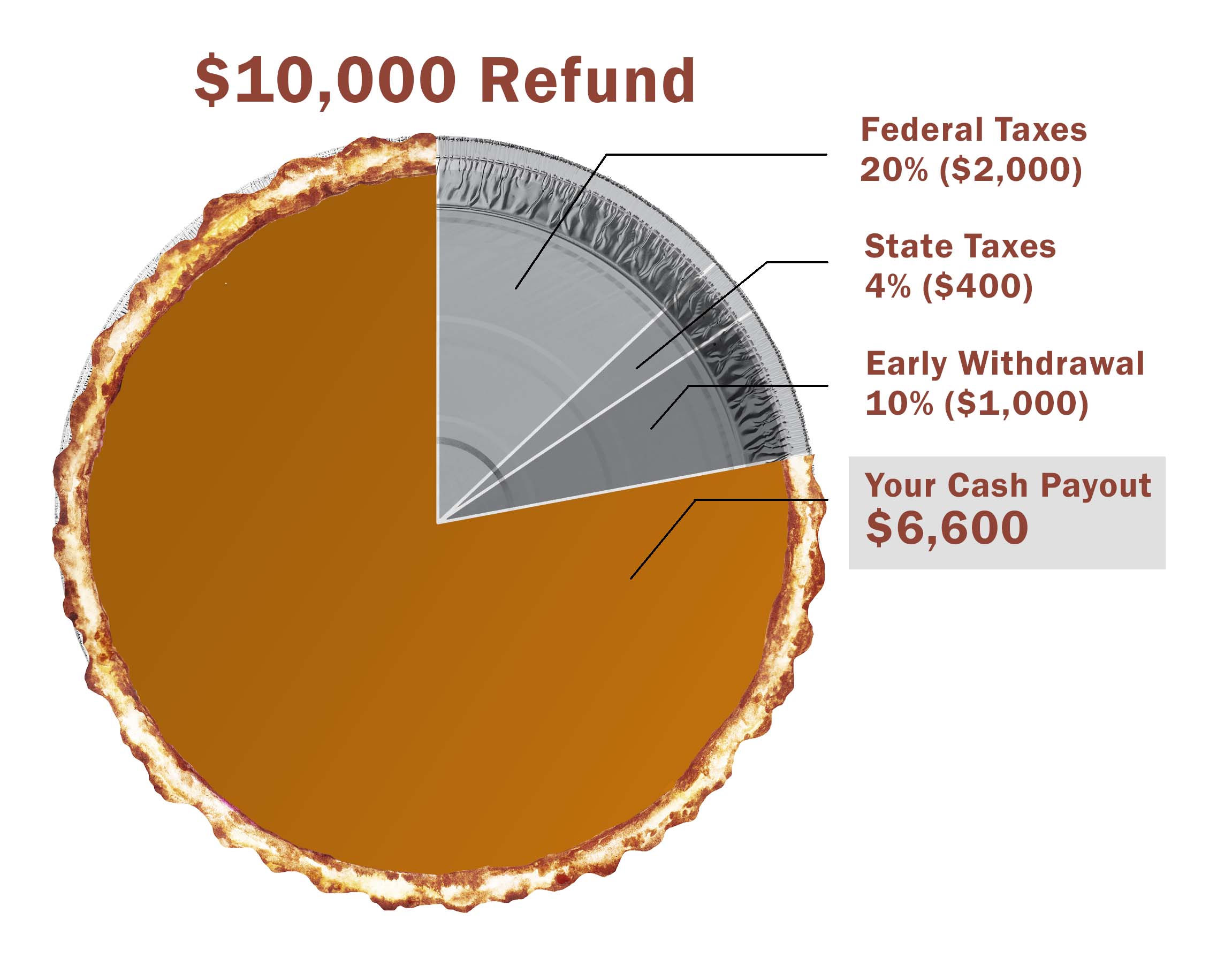

The refund amount may not be what you expect. VRS withholds federal and state taxes if you have your refund paid directly to you. The IRS may impose an additional tax penalty for early withdrawal, depending on your age.

Consider These Steps Before Requesting a Refund

You can defer taxes by rolling your refund into an Individual Retirement Account or another qualified retirement plan.

- Check your balance: Log in to myVRS to review your member contribution account balance and a summary of your plan’s other benefits, if applicable. Knowing this information may help you weigh your options.

- Research the details: Refer to your plan handbook and the VRS website for more information (see Leaving Employment).

- Seek guidance: Consult your human resources officer or contact VRS for assistance.

You can request a refund online using myVRS.